Fish oil is a major source of the omega-3 fatty acids, docosahexaenoic acid (DHA) and eicosapentaenoic acid (EPA), which play an important role in regulating body functions and health. While there is strong evidence the regular consumption of omega-3 fatty acids can reduce the risks of heart disease, high blood pressure, arrhythmia, arthritis, and diabetes, they may also be beneficial in reducing the incidence of cancer, depression, psychosis and multiple sclerosis. Pregnant women are also encouraged to consume fish oil as EPA and DHA are important in foetal development, especially for the brain and retina. As a result of the scientific evidence regarding health benefits, EFSA has approved the health claims for EPA and DHA and recommends a daily intake of 250 mg to maintain normal cardiac function.

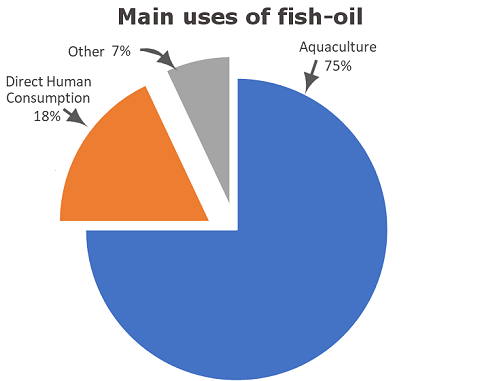

Oily fish, such as salmon, mackerel, tuna and herring, are major sources of omega-3 fatty acids. However, high levels can also be found in the oils from microalgae (such as Schizochrytium and Nannochloropsis), krill, seeds and nuts. DSM reports that they only use side streams from the fishmeal or edible canning industries as their source of fish oil, thus no fish are caught specifically for the production of oil. The main applications of fish oil are for aquaculture and human consumption. The fish oil for human consumption represents 18% of the market (Figure 6) and includes mostly supplements and functional foods. Fish oil products, which are usually sold as capsules to consumers, contain both DHA and EPA, although the amount of each and the ratio often vary. Products may also contain other ingredients, such as omega-6 fatty acids (mostly found in nuts and seed), coenzyme Q10 (ubiquinone, CoQ10), and vitamins (D3 and E), to differentiate themselves on the market (see amazon.com for more details).

There is a growing demand for fish oil as a nutritional supplement, as more consumers become aware that the Western diets are deficient in important omega-3 fatty acids. However, most of the fish oil is used in aquaculture (75%, see Figure 1.3.3), as, together with fishmeal, they are the most nutritious and digestible ingredients for farmed fish. However, it has been reported that the decline in fishmeal and fish oil production, together with higher prices, has seen then need to look for alternative sources, such as fish side streams and krill. Moreover, these ingredients are being used more selectively and for specific stages in the production, namely as part of the hatchery, broodstock and finishing diets.

The other uses of fish oil (7%, see Figure 1.3.3) include animal nutrition and pet food and pharmaceuticals.

The fish oil market is well established and involves big industrial players, including the AQUABIOPRO-FIT consortium partner PELAGIA, following the acquisition of a leading global brand of high-quality, marine-based omega-3 EPA/DHA fatty acid concentrates EPAX®, and others such as BASF, DSM and Croda. The products are mostly distributed in liquid or capsule form, although microencapsulation techniques have also been used to produce the fish oil in a powder form (DSM). Despite the presence of the larger companies, there are SMEs who have also entered the market, which shows that there are still opportunities for both large and small companies to have a share in this market (Supplementary Table 1.3.2.).

In 2016, the global fish oil market was evaluated at US$2.22 billion (€1.91 billion) and is expected to grow at a CAGR of 5.8% to reach US$3.69 billion (€3.18 billion) in 2025. The combined growth in the global aquaculture industry, as well as consumer awareness of the health benefits of fish oil, has driven the growth in the fish oil market. However, fishing quotas that limit the supply of fish have also impacted the growth of the fish oil industry. It is speculated that the utilisation of fishing side stream products may help alleviate these issues with supply and demand.

China is the largest consumer of fish oil, due to its proximity to aquaculture in the Asia-Pacific region. However, the global production is led by Peru, USA, Chile and China (Supplementary Table 1.3.3.).

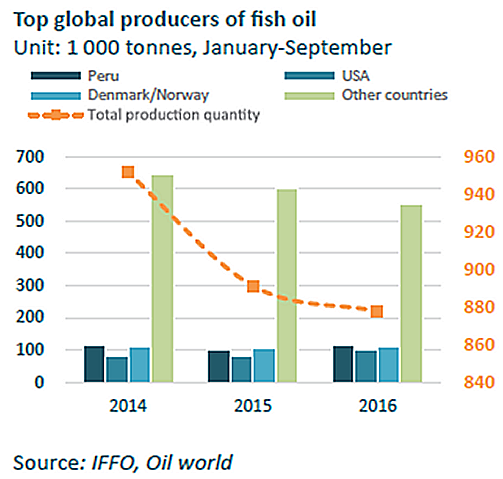

The total amount of fish oil produced strongly depends on the production in Peru, which is highly influenced by the climate phenomena El Niño and La Niña. El Niño, where the Pacific Ocean temperature can increase by 5℃, affects anchoveta production, which is one of the main fish used to produce fish oil. The combination of the last El Niño, which took place from 2014 to 2016, and reduced fishing quotas saw a decline in fish oil production during this period (Figure 1.3.4). However, in 2017, global production increased again due to the more favourable La Niña (lowering of ocean temperatures) off the Peruvian coast and increased landings of small pelagic fish in the Nordic countries.

In Europe, approximately 190 000 tonnes of fish oil are produced per year, with Norway, Denmark and Iceland being the main producers. In 2017, 86 000 tonnes of fish oil were produced by these three countries, the highest production level since 2003. While the main source of oil is from pelagic fish, these recent figures also include oil from salmon trimmings. Once again, the production of fish oil is strongly dependent on the availability of the fish, which is related to the fishing quotas.

The EU also has an integral position with regards to the trading of fish oils. In 2016, the EU reached peak exports at 127 064 tonnes of fish oil valued at €237 million, an increase of 20% and 12% respectively compared to 2015. Denmark was the main exporter, showing a similar increase in export volume of 19% to 113 637 tonnes (€188 million), with Norway being the main non-EU market. On the other hand, in 2016, the EU imported 177 093 tonnes, corresponding to a 1% growth at an increase in value of €27 million. Norway is the main supplier of fish-oil to the EU (57 070 tonnes at €1115 /tonne) with the USA in the second position (39 929 tonnes at €1669/tonne) followed by Peru (21 996 tonnes). Of all the EU countries, Denmark is the largest fish oil importer, purchasing 85 755 tonnes of fish oil from non-EU countries.

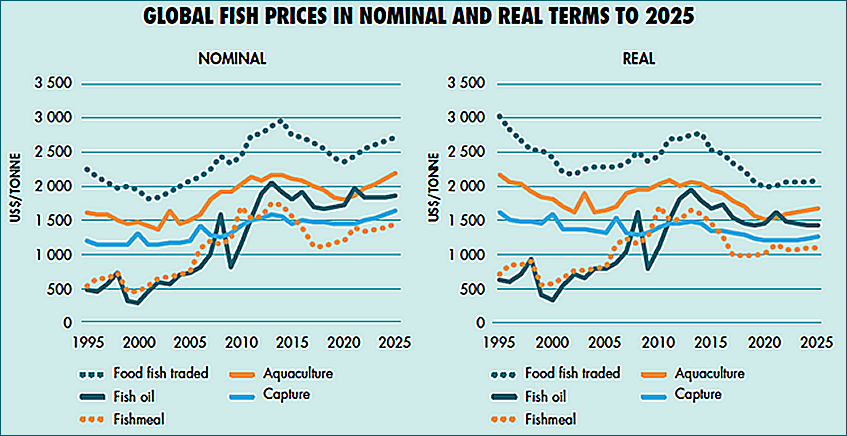

Variations in production capacity and fishing quotas increase the volatility of the fish oil market and contribute to price pressure. In 2017, lower quotas for the second fishing season in Peru resulted in an increase in the fish oil price on a global level to around US$1600/tonne (approximately €1400/tonne). Price decreases were also seen in 2015, when the production capacity in Peru and China dropped (Figure 1.3.5). However, with the increased use as nutritional supplements and its importance in fish feed, demand for fish oil is expected to remain high. Thus, as long as the fish supplies are available, the price is likely to remain relatively stable in the near term. In the long-term, however, economic factors that affect the fishing industry, along with a project reduction in the use of fish oil in fish feed, is likely to result in lower fish oil prices by 2025.

As the fish oil market is already well established, trying to gain market share is one of the biggest barriers for other fish oil producers. Moreover, as the fish oil production is currently closely linked to the quotas and hauls from the fishing industry, the is volatility in the market and product pricing based on the availability of biomass resources. As a result of this, there is also increasing competition from other oil sources, such as microalgae, krill, seeds and nuts, which are also rich in omega-3 fatty acids. Moreover, the microalgae, seeds and nuts are suitable for vegans, which is not the case for the oils obtained from fish.

Perhaps the biggest opportunity for the AQUABIOPRO-FIT project is the use of sidestream products and side streams from the fishing industry as a source of fish oil. While some companies are already taking this approach (e.g. DSM), it is apparent that there are more could be done to make use of such raw materials. Furthermore, utilising these sidestream products may help to maintain certain volumes that may have otherwise dropped due to low fishing quotas. With the increased incidence of heart disease, consumers are becoming more aware of the health benefits of omega-3 fatty acids DHA and EPA. This is expected to see a shift in the market share towards health supplements, this is expected to increase demand particularly in Europe and other Western countries. With the fish oil price project to drop slightly over the next 10 years, this may also make fish oil supplements more affordable for a wider consumer market.